2024 Diwali Celebration Trends: A Resurgence of Tradition Amidst the Digital Era

Nov 15, 2024

Diwali, India’s quintessential Festival of Lights, has always been a tapestry woven with rich traditions and cultural grandeur. As a year 2024 is reflective of the emerging trends that indicate a significant shift back to traditional rituals, with digital and modern celebrations adapting to new consumer behaviors shaped by recent global events and technological advancements. This comprehensive report delves into the evolving preferences for Diwali celebrations across diverse demographics, revealing a collective desire to reconnect with traditional practices, albeit infused with modern nuances. The findings provide crucial insights for brands looking to align with the sentimental and festive dynamics of the Indian market during this pivotal season.

1. Mode of Celebrating Diwali

Revival of Traditional Diwali

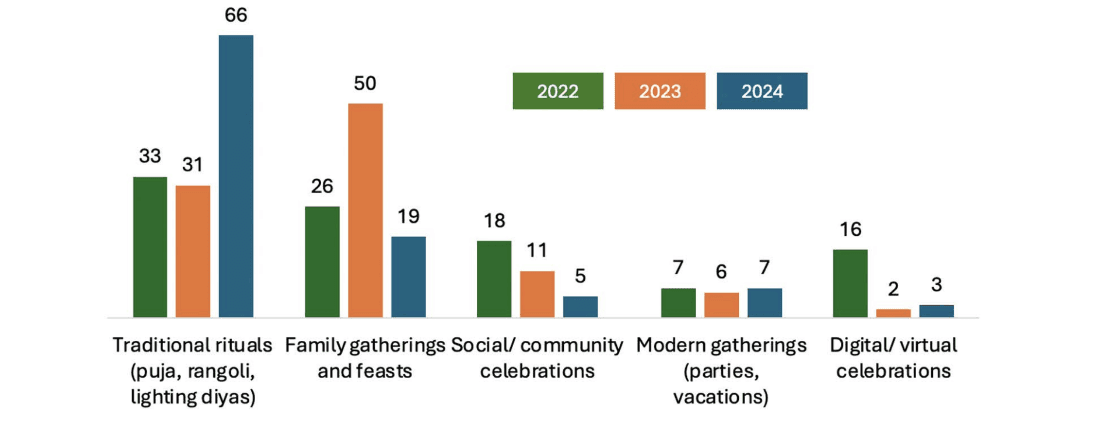

The year 2024 stands out as a milestone in the reclamation of India’s ceremonial heritage, with a striking 66% of participants poised to embrace traditional Diwali customs. This marks a notable increase from the 31% recorded in 2023, illustrating a robust revival of cultural fidelity. This trend not only signifies a return to conventional festivity but also reflects a broader societal yearning to reestablish a sense of normalcy and continuity after the dislocations caused by the pandemic and accelerated digitalization.

Decline of Digital Celebrations

The allure of digital celebrations has seen a steep decline, plummeting from a modest 16% in 2022 to an all-time low of 3% in 2024. This trend indicates that while virtual gatherings served as a necessary bridge during social distancing mandates, they lack the emotional resonance and communal joy traditionally associated with Diwali. The data suggests a pivotal shift back to in-person engagements, rekindling the communal spirit that virtual platforms struggle to replicate. While generally low in prevalence, there’s an indication of slight growth in digital celebrations in the Metro and Northern regions from 2022 to 2023.

Increase of Modern Gatherings

Despite a tidal wave returning to traditional rituals, a segment of the populace maintains an affinity for contemporary celebrations, with interest in modern gatherings like parties and

vacations remaining stable at around 6-7% over the years. This consistency underscores a niche but significant demographic that juxtaposes modern revelry with traditional observances, suggesting an enduring appeal of diversified celebration styles. There's an increasing trend for modern celebrations, with Metro areas and the North region showing particular affinity in 2023 compared to 2022. The East region, however, shows a decline in modern gatherings for Diwali in 2023.

The younger generations from 18-27 and 28-42 age groups show a preference for modern gatherings, with significant participation in parties and vacations. This is especially pronounced in the 28-42 age group in Metro areas.

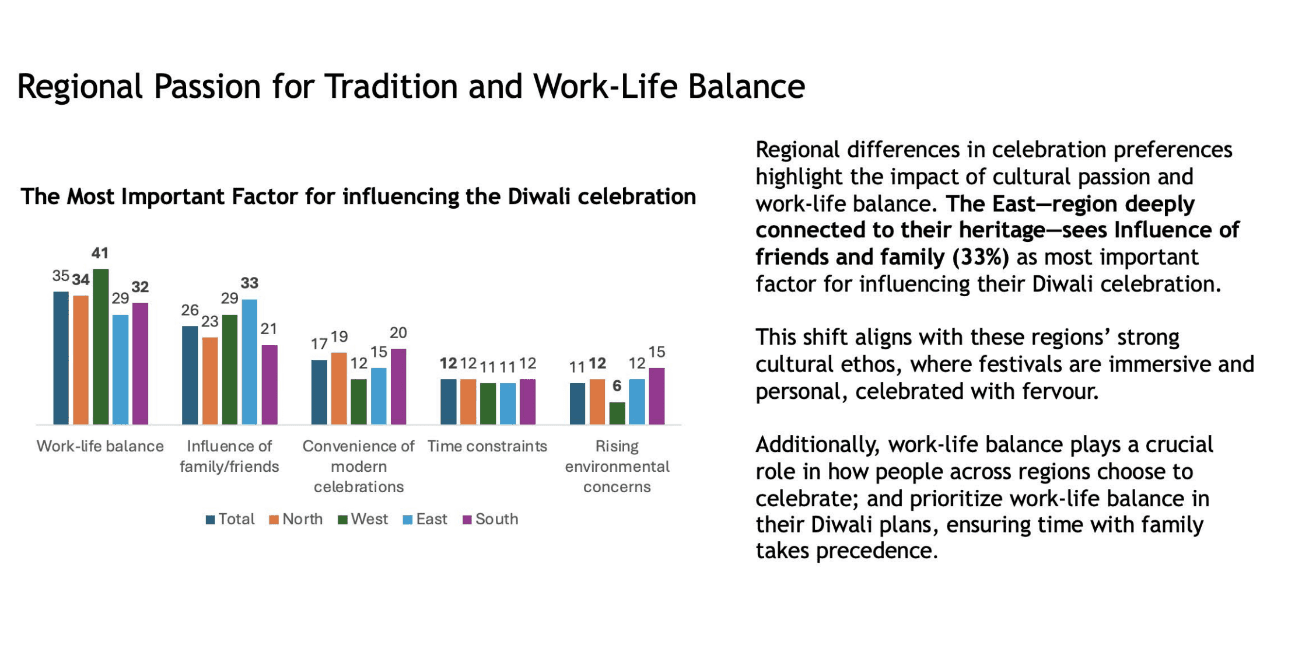

The most significant factor affecting changes in celebration style, particularly in Metro areas and among younger demographics has been the work-life balance. This factor sees higher importance in regions with potentially busier, more urban lifestyles. Also a considerable factor, particularly among the younger demographics, influencing a shift towards more convenient celebration styles. Noted particularly among the 18-27 age group across all regions, indicating a shift towards easier, perhaps less time-intensive celebrations. Older Generations ranging from 43-60 and above 60 maintain a higher engagement with traditional rituals and family gatherings compared to younger groups, showing minimal involvement in modern types of celebrations.

These aspects and factors can help brands to tailor products, services, or content to meet the evolving preferences of different demographic segments during Diwali.

(All the numbers in the report are in percentages)

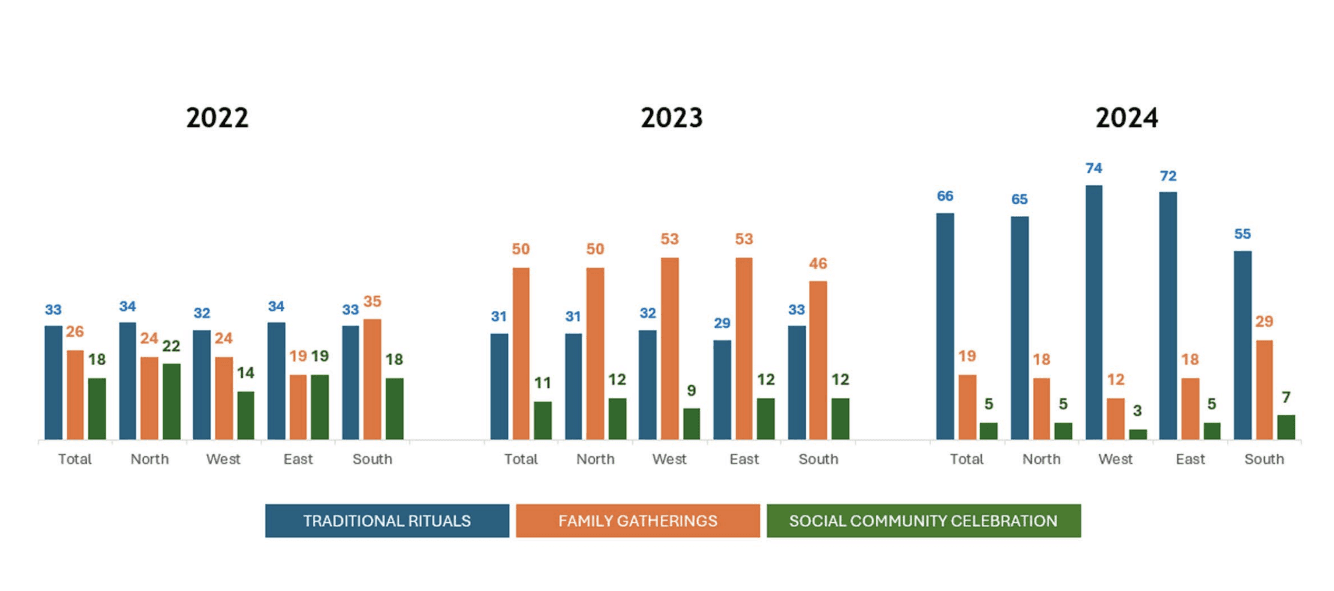

Diverse regional Variations in Celebration Styles

The regional breakdown of celebration preferences illuminates the rich cultural tapestry of India. The West (74%) and East (72%) exhibit a strong preference for ritual-centric festivities. In contrast, the South (29%) shows a pronounced preference for family-oriented gatherings, significantly higher than the overall average (19%). These regional nuances underscore the diverse ways in which Diwali is celebrated, shaped by historical, cultural, and social influences.

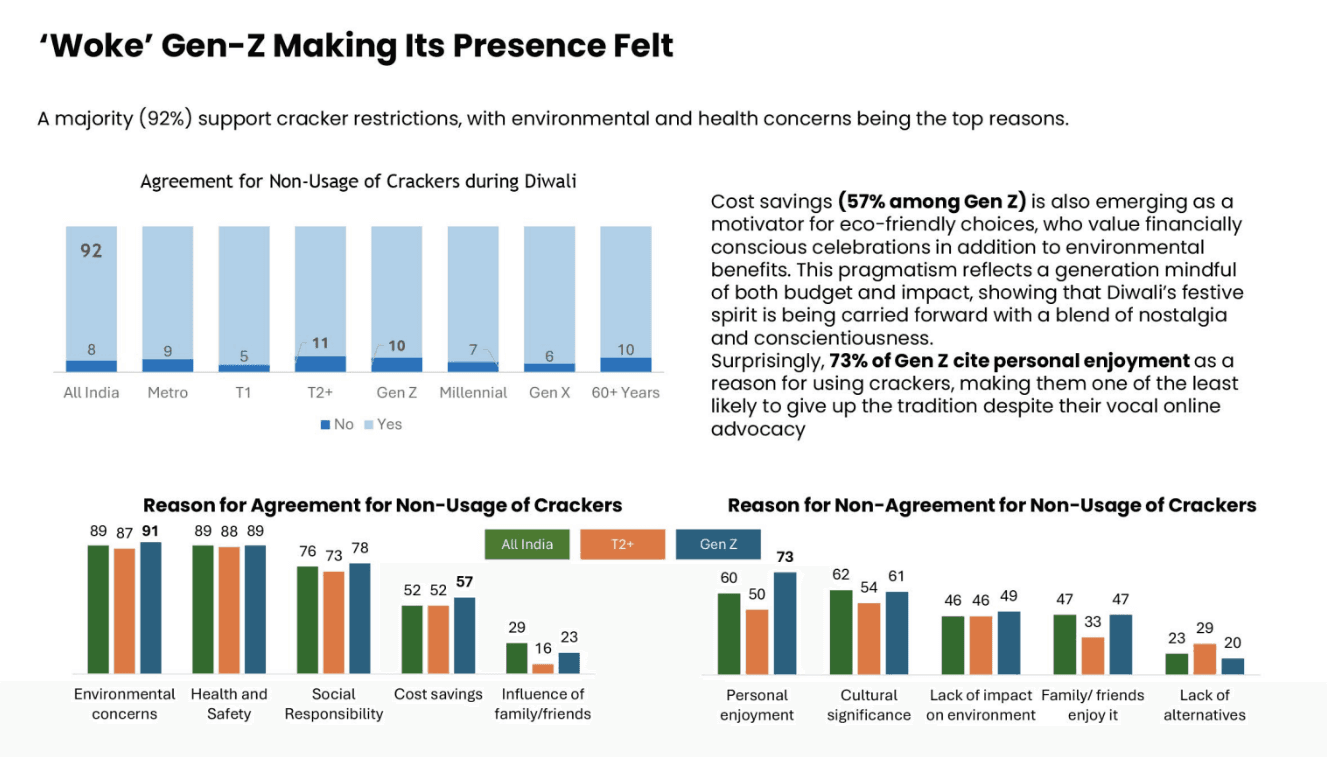

Gen-Z: A Confluence of Tradition and Innovation

The Gen-Z demographic emerges as a fascinating study in contrasts, with 73% partaking in the traditional use of firecrackers for personal enjoyment while simultaneously advocating for environmental issues online. Additionally, 57% of Gen-Z participants are drawn to eco-friendly celebrations for their cost-effectiveness, illustrating a pragmatic yet environmentally conscious approach. This dual behavior highlights the complex interplay between traditional festivity and modern values within younger demographics.

2. Festive Shopping Bliss

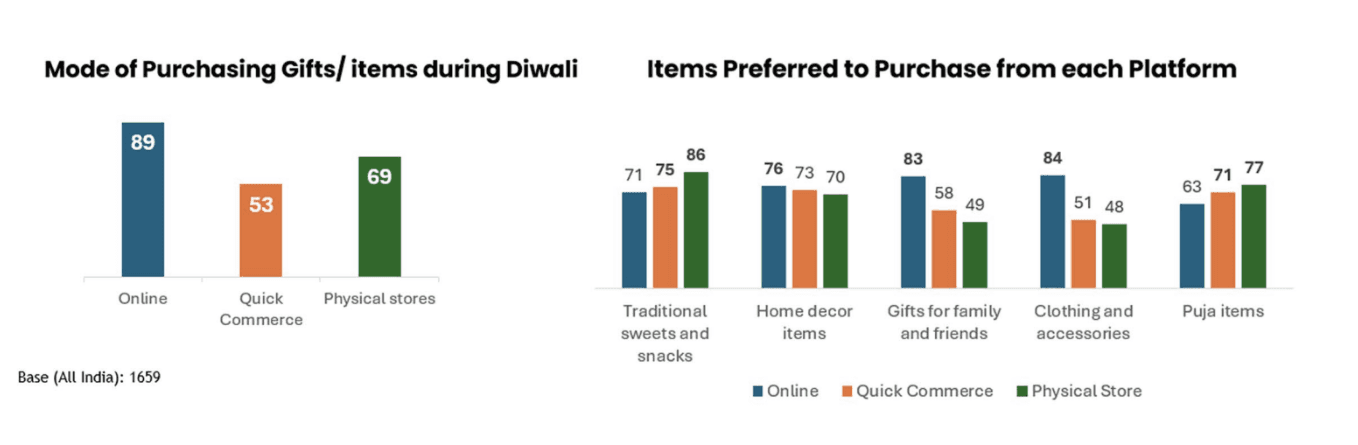

Online shopping through e-commerce websites and apps is the dominant choice for Diwali purchases among all demographics, especially noted in North and metro areas specially among younger individuals aged 18 to 42 years. Clothing and accessories also see significant purchases online, especially among the female demographic in the North, while electronics tend to be more frequently purchased by younger consumers and males. Besides these the other items frequently bought online include traditional sweets and snacks, home decor items like candles and diyas.

Factors driving online purchase:

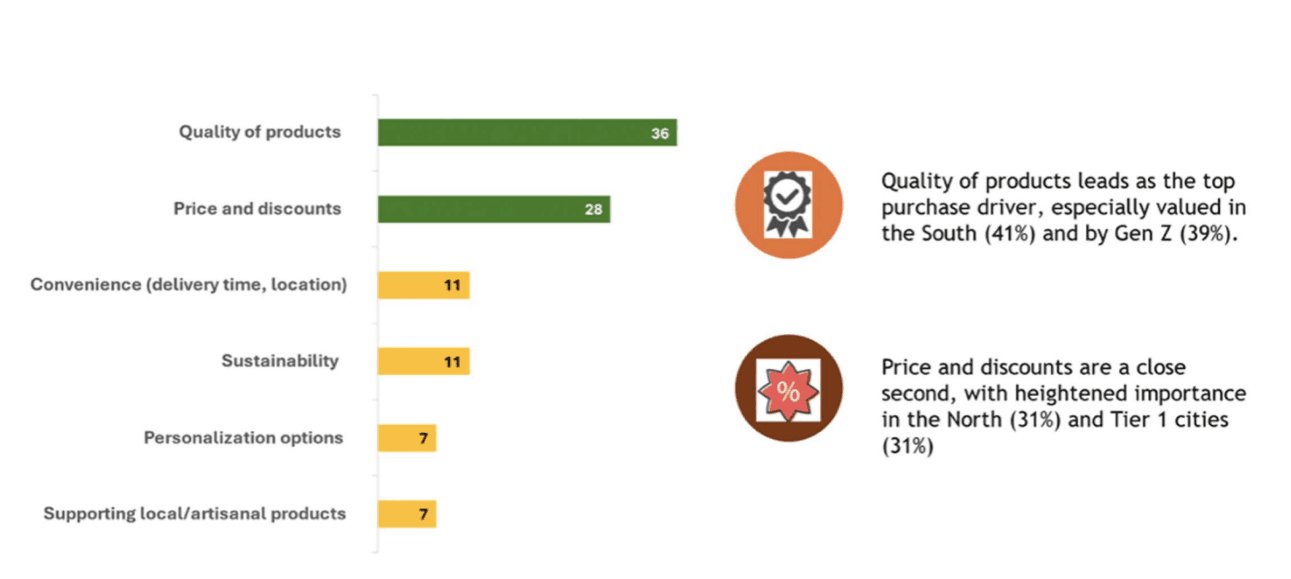

Price and Discounts consistently remain the top driving factor for purchasing decisions during Diwali across almost all demographics, especially noted as the highest priority in the Metro areas and among younger age groups (18-27 years). The emphasis on price and discounts indicates a strong price sensitivity among consumers during festival shopping.

At the same time Quality of Products is the second most significant factor, particularly important in the East region and among older demographics (43-60 years and above 60 years). This reflects a concern for product quality over just price, which is more pronounced as the age of the consumer increases.

At the same time Quality of Products is the second most significant factor, particularly important in the East region and among older demographics (43-60 years and above 60 years). This reflects a concern for product quality over just price, which is more pronounced as the age of the consumer increases.

Delivery Speed has consistently ranked as the most important aspect of online shopping across all demographics, highlighting the demand for quick and efficient service during the festival season.

Product Range and Availability has been particularly important to consumers, reflecting the desire for a wide selection of products available for immediate purchase.

Customer Reviews has been more importantance among younger demographics (18-42 years), indicating that younger consumers are more influenced by peer reviews and testimonials.

Delivery Speed has consistently ranked as the most important aspect of online shopping across all demographics, highlighting the demand for quick and efficient service during the festival season.

Product Range and Availability has been particularly important to consumers, reflecting the desire for a wide selection of products available for immediate purchase.

Customer Reviews has been more importantance among younger demographics (18-42 years), indicating that younger consumers are more influenced by peer reviews and testimonials.

Quick commerce platforms are also popular, particularly for last-minute purchases of home decor items and traditional sweets and snacks. These platforms are notably favored by the younger age group due to the quick delivery and convenience they offer. In the Metro areas and among Tier 1 regions, urban shoppers have highly valued the convenience of online shopping. A significant portion of consumers has used quick online commerce platforms very frequently, with the highest usage reported in the North and among the younger demographics (18-27 years). While a majority are already frequent users, a small percentage of consumers are considering the use of these platforms, suggesting potential growth in this sector.

Despite the rise of online shopping, a significant number of respondents still show a preference for physical stores, especially for purchasing home decor items and clothing and accessories. This preference is relatively higher among the older demographics, above 60 years, who value the traditional shopping experience.

While digital platforms are becoming increasingly popular for festival shopping, particularly among younger and urban populations, physical stores continue to hold significant appeal for many, especially for categories like sweets, snacks, and clothing. This blend of modern and traditional shopping methods provides valuable insights for retailers to tailor their marketing and sales strategies during Diwali.

There is a clear trend towards digitalization in shopping habits, with a strong lean towards online and quick commerce platforms, especially among younger demographics and in urban areas. However, traditional shopping experiences continue to hold significant value for many, particularly for certain categories of products. This blend of modern and traditional shopping behaviors offers insights into consumer preferences that can be leveraged by retailers for targeted marketing and sales strategies during Diwali.

Blending Convenience with Cultural Connection

3. Shift towards healthier living

A growing health consciousness is evident in the food choices during Diwali, particularly among respondents in the North and Metro areas, and notably within the younger demographic (18-27 years). While many individuals continue to indulge in festive treats, there's a notable trend towards actively avoiding unhealthy foods. This reflects a balance between maintaining health consciousness and indulging in traditional festive enjoyment. The preference for healthier alternatives is strong, with many opting for low-sugar sweets and organic snacks, especially prevalent among younger and metro-based populations, indicating a shift towards healthier festive diets.

4. The gifting trend

Personalized items and hampers have become a popular choice for Diwali gifts, particularly favored in the North and among younger demographics. This trend highlights a shift towards more customized and meaningful gift-giving practices.

In addition, there is a notable preference for artisanal and luxury products, especially among Metro residents and the 28-42 age group. This suggests a taste for unique and high-quality gifts that resonate with urban sensibilities. Furthermore, digital gifts such as vouchers and experiences are increasingly appealing, especially to younger people and those living in metro areas. This reflects modern consumption habits and the significant influence of technology on gift-giving trends. Gift cards and vouchers are another favorite, particularly among younger demographics, highlighting a trend towards more flexible gifting options.

Experiences are also increasingly valued over material gifts, a trend that is particularly pronounced in the West region and among younger demographics. This shift in consumer behavior highlights a preference for engaging in activities that foster lasting memories rather than accumulating physical items. Across various demographics, the inclination towards experiences ranges from moderate to high, suggesting that experience-oriented celebrations are becoming a preferred way of marking Diwali. This trend reflects a broader movement towards valuing experiences that enrich life and foster personal connections, altering traditional festive gift-giving practices.

5. Preference for Locally Made or Artisanal Products

There is a strong preference for buying locally made or artisanal products among a majority of respondents, with this trend being particularly notable in the West and among younger demographics. Several motivations drive this preference: The primary motivator is the perceived quality and craftsmanship of these products, which is especially appreciated in the West and North regions. Supporting local artisans also plays a significant role, reflecting a desire to contribute positively to the community through purchasing decisions. Additionally, the allure of unique designs and products is highly valued, particularly in Metro areas and among younger

demographics, underscoring the demand for distinct and differentiated items in the market. Sustainability is another notable motivation across all demographics, indicating a growing consumer focus on environmentally friendly products. These motivations combine to shape a robust market for local and artisanal goods, suggesting a broader shift toward more sustainable, community-supportive, and unique consumer choices.

Strategic Insights for Brands

Harnessing Cultural Authenticity

To tap into the burgeoning trend towards tradition, brands should consider authentically integrating cultural elements into their offerings. Campaigns that resonate with traditional values, enhanced by genuine narratives, are likely to strike a chord with consumers seeking depth and authenticity in their festive purchases.

Regional Customization

Brands are advised to tailor their strategies according to regional preferences. For example, marketing campaigns in the South could focus on family-centric products and services, whereas in the West and East, emphasis on items for traditional rituals could drive engagement and sales.

Youth Engagement Through Innovation

With Gen-Z balancing tradition with modernity, there is a substantial opportunity for brands to innovate within traditional frameworks. Products that combine cultural significance with sustainable practices can appeal to this demographic's environmental and ethical sensibilities.

Rethinking Digital Celebration Tools

Given the decline in digital celebrations, brands should consider developing more engaging and interactive digital solutions that better simulate the warmth and camaraderie of physical gatherings. This could especially appeal to the diaspora and families living apart, providing them with a means to connect deeply despite physical distances.

Conclusion

This year's Diwali celebration landscape beautifully illustrates a harmonious blend of India's rich traditions with the practicalities of modern life. From the reinvigoration of cultural customs among the youth to strategic uses of technology for convenience, these trends demonstrate an evolving celebration of Diwali—one that honors the past while adapting to current realities. For businesses, understanding and integrating these nuanced consumer trends into their Diwali strategies could yield significant dividends. As India dresses in its festive best, the essence of

Diwali—centered around familial ties and communal spirit—remains a potent narrative that brands can enrich and embody in their offerings. As we look to the future, it is clear that while convenience will remain influential, the essence of Diwali will continue to lie in shared, in-person experiences that digital platforms cannot replicate.

Methodology

Amid this rapidly evolving consumer story during the festivities, we took a moment to introspect and confront some probing inquiries to sift through the complexities and uncover reality. For the methodology we at Market Xcel deployed an online survey for collecting data, which allowed for efficient access to a diverse audience across different geographical locations. The survey was conducted over a specific period, typically spanning a few weeks to a few months, to ensure that the data reflects current trends and opinions.

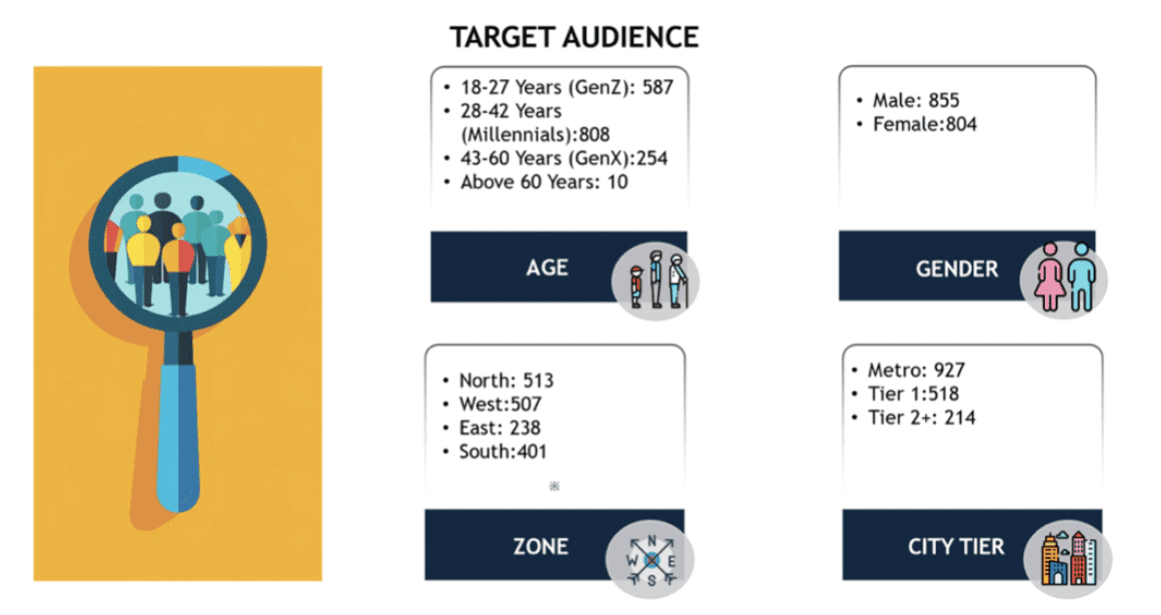

The sample of the study comprised of a total of 1,659 respondents who were stratified by age, gender, and city tier to compile a comprehensive dataset. Demographic segmentation was applied, categorizing participants into specific age groups (18-27, 28-42, 43-60, above 60), genders (male and female), and city tiers (Metro, Tier 1, Tier 2+). Additionally, the geographical distribution included respondents from the four major zones of the country—North, West, East, and South, aiding in analyzing regional variations in consumer behavior.

The data processing involved cleaning and processing the survey data using statistical software, where outliers and incomplete responses were removed to ensure accuracy. The responses were also weighted and normalized to better reflect the population distribution, especially if the sample wasn't perfectly representative.

The primary aim was to analyze the target audience for marketing purposes, focusing on understanding consumer preferences and behaviors across different demographic and geographical segments. The insights derived are intended to be used to tailor marketing strategies, product development, and customer engagement tactics to better meet the needs of each demographic segment.

This methodological overview provides stakeholders form the branding and marketing ecosystem with a structured insight into how the data was collected, processed, and analyzed, demonstrating the robustness and practical applications of the data presented in the report.