Aspirational brands are upturning conventional wisdom and redefining consumption attitudes

Senior Consultant

Historically, economists have maintained that societies transform in predictable ways as income percolates deeper and wider. When it comes to consumption, the traditional wisdom states that consumers initially focus on providing for their physiological needs like food, shelter etc., followed by keenness to socialise with others through better transportation and improved communication methods. This is followed by need to look good and stay healthy as they seek social approval and self-esteem needs. Further, as they move the consumption ladder, they look to self- actualise by seeking better quality of life through new learning and enjoying new experiences.

Upturning consumption ladder

Powerful forces are at work, driven by aspirational brands to upturn this conventional wisdom. Based on the brand buzz generated by these aspirational brands, as measured in the Brand Xcel study, one can surmise that a young nation like ours is pushing itself towards higher order need states even as lower order needs remain unfulfilled or partially fulfilled.

At the same time, India being such a variegated geography, we see a slow diffusion in aspirational adoption. Urban India 1, driven by Metros and Tier I towns are setting the trends for Urban India 2 composed of Tier II and smaller towns to follow suit. Rural India, despite lagging on these trends, driven by lower Income levels, is keen to adopt wherever brand availability and price barriers are being bridged. It is interesting how as Ecommerce is booming in Urban 1 and will soon percolate down, social media is beginning to turn stale in Urban 1 even as it sees robust growth in rest of India. Personal care and OTT, on the other hand, are seeing large adoptions across all geographies.

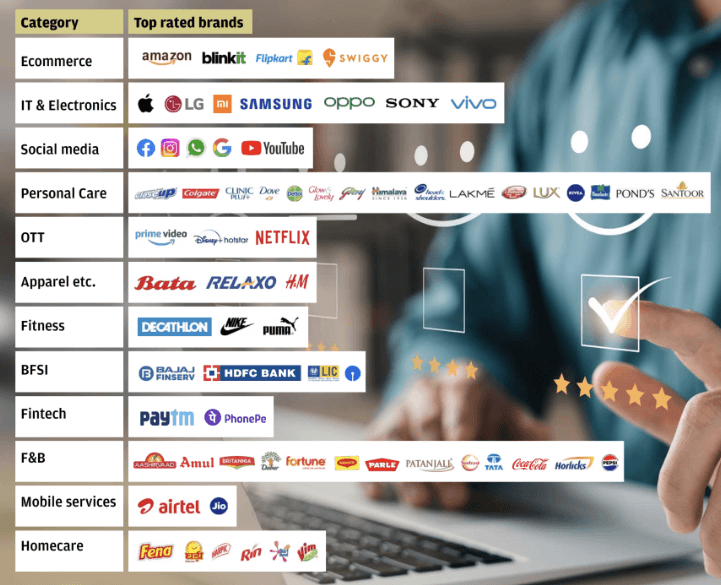

What is even more interesting are kind of brands driving these categories rise up on their aspirational imagery. One can see how categories and brands with “new” news continue to excite consumers to rate them higher.

Gender, Age and income skews drive some categories upwards

When we study the popularity of these categories by gender, age and income skews, we realise the influences of youth in driving categories like Ecommerce, IT & Electronics as well as social media. Social media is driven by those from lower income strata even as popularity of emerging categories like Ecommerce, personal care and OTT are driven by women taking a lead. As expected, Fitness, BFSI and Fintech are more male and higher income driven.

Brands with significant male skew include HDFC, Nike, Bajaj and Apple and female skews include the usual suspects in personal and home care category as well as brands like Facebook, Netflix, Amazon, Hotstar etc. On the other hand, brands like Apple, Google, Samsung, Nike, Puma, Instagram and Amazon are more youth attracting brands while those like Amul, Dettol, Lifebuoy, Jio, Aashirwad, Dabur etc have a more middle age and older age group skews. While brands like Apple, Sony, LG and Samsung have a higher income skew, those like Blinkit, MI, Bajaj, Oppo and Jio have a lower income skew.

Consumption attitude changes

Media consumptions attitudes are predictably skewed towards social media consumptions in Urban 1 and 2 though traditional media continue to be far ahead in rural geography. The other attitudes going through major shifts are around sustainability issues. These not only include conventional views like conserving water and electricity but also emerging issues like segregation of garbage at home, lifestyle changes for better environment, recycling and use of sustainable products.

Religious sentiments also seem to have grown with a majority claiming to worship at home, visit religious functions and places of worship rather regularly. Focus on staying happy and energetic seem to be of paramount importance to consumers. This signals a growing driver of emotional needs to be catered to by brand relative to functional aspects of the product in question. Emerging areas of attitudinal change include greater involvement in health and fitness activities like Yoga, sports, walking, jogging etc., as well as investment in self-improvement.

Rural customers are aiming to be conventionally aspirational. For example, education of their children, staying healthy, having good family environment and being able to amass money are priorities for them.

Overall, these high aspirational values are not only driving Indian consumers to leap frog to experiencing high order needs. In so doing, they are upturning conventional ideas on how consumers usually progress over time.